Trading with Ichimoku Kinko Hyo: A Comprehensive Guide

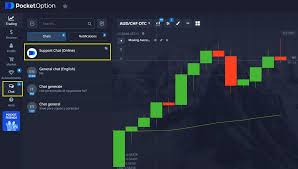

Ichimoku Kinko Hyo is a versatile trading system that provides insights into price trends, balance, and momentum. It is widely used in various markets, including forex, stocks, and commodities, making it a robust tool for traders. This article will delve into the components of this indicator and how to effectively use it in your trading strategies. For those looking to get started with trading using Ichimoku Kinko Hyo, you can check out Trading with Ichimoku Kinko Hyo in Pocket Option торговля с Ichimoku Kinko Hyo Pocket Option.

What is Ichimoku Kinko Hyo?

Ichimoku Kinko Hyo, often simply referred to as Ichimoku, translates to „one look equilibrium chart.“ Developed by Goichi Hosoda in the 1930s, this indicator offers a comprehensive view of market trends at a glance. Unlike traditional indicators that provide limited information, Ichimoku encompasses multiple elements that highlight potential support and resistance levels, as well as the overall trend direction.

Components of Ichimoku Kinko Hyo

The Ichimoku system consists of five main components:

- Tenkan-sen (Conversion Line): This is calculated using the average of the highest high and the lowest low over the last nine periods. It serves as a short-term indicator of price movement.

- Kijun-sen (Base Line): The Kijun-sen is derived from the highest high and the lowest low over the last 26 periods. It acts as a longer-term trend indicator.

- Senko Span A (Leading Span A): This line is computed by averaging the Tenkan-sen and Kijun-sen, then plotted 26 periods into the future. It forms an upper boundary of the Ichimoku cloud.

- Senko Span B (Leading Span B): This is calculated using the highest high and lowest low over the last 52 periods, also plotted 26 periods into the future. It forms the lower boundary of the cloud.

- Chikou Span (Lagging Span): This line represents the closing price shifted back 26 periods, providing insight into the trend’s momentum.

Interpreting the Ichimoku Cloud

One of the unique features of the Ichimoku system is the cloud it creates between the Senko Span A and B lines. This cloud serves as a visual representation of support and resistance levels:

- When the price is above the cloud, it indicates an upward trend, while a price below the cloud suggests a downward trend.

- The cloud’s thickness can reveal the strength of the trend; a thicker cloud indicates stronger support or resistance.

- The color of the cloud can also be important; a green cloud indicates a bullish sentiment, while a red cloud indicates bearish sentiment.

Trading Signals with Ichimoku Kinko Hyo

Traders use various signals derived from the Ichimoku components to make informed trading decisions:

- Crossovers: A bullish signal occurs when the Tenkan-sen crosses above the Kijun-sen, and a bearish signal is indicated by the opposite crossover.

- Price Action and Cloud Breakouts: When the price breaks above the cloud, it can signal a buying opportunity. Conversely, a break below the cloud can signal a sell opportunity.

- Trend Confirmations: Validating a trend can be done by observing where the Chikou Span is in relation to the price. If it is above the price, it confirms bullish momentum and vice versa.

Best Practices for Ichimoku Trading

To maximize the effectiveness of Ichimoku in your trading, here are some best practices:

- Timeframe Selection: The Ichimoku indicator works on various timeframes, but it’s essential to select one that aligns with your trading style—whether short-term or long-term.

- Combining with Other Indicators: While Ichimoku is powerful on its own, combining it with other indicators like RSI or MACD can provide additional confirmation for your trades.

- Risk Management: Always incorporate solid risk management practices with stop-loss orders to protect your capital against adverse market movements.

Conclusion

The Ichimoku Kinko Hyo offers a comprehensive view of the market and can be an essential part of a trader’s toolkit. While it may seem complex at first glance, understanding its components and how they interact can greatly enhance your trading strategy. Whether you are a beginner or an experienced trader, integrating Ichimoku into your trading plan can lead to more informed decisions and hopefully improved trading results. As you gain experience, remember to adapt the principles of this indicator to fit your trading strategy and risk tolerance.